Wells fargo does not provide a minimum credit score requirement for its rv loans but credit score will be a factor in determining whether you qualify and at what interest rate.

Rv interest rates wells fargo.

Wells fargo provides secured vehicle financing up to 100 000 including rv loans for campers motorhomes and travel trailers with funding in one to two business days.

But if you have poor credit such as a fico score below 580.

Credit unions according to the national credit union administration credit unions offer lower average rates on all types of loans compared to other lenders.

Some of the biggest banks such as bank of america and chase don t have rv financing among their products however usaa bank and wells fargo bank do offer rv loans.

Wells fargo rv loans.

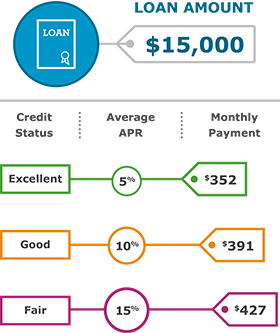

Rates typically begin at just a few percent and can be as high as 20 or more for those with sub prime credit.

Rate discounts are.

Each rate adjustor applies independently.

Check back periodically as we regularly add new rates pages.

The bank will also verify your income and the value of the rv which will be used as collateral to back up the loan.

What are the current interest rates for rv loans.

Wells fargo can provide financing for a variety of specialty vehicles including offering rv loans for campers motorhomes travel trailers tent trailers mini motorhomes folding trailers toterhomes and toy haulers.

Annual percentage rate.

If you have excellent credit current rv financing rates start around 4 29 percent.

A 65 399 loan includes a 399 processing fee for 5 years with a fixed interest rate of 3 747 would have an apr of 3 99 and 60 monthly payments of 1 96 97.

Interest rates are determined by a combination of factors.

Multiple rate adjustors may apply for a single request.

Rates may be higher for loans to purchase an rv from a private party smaller loan amounts longer terms used rvs and a lower credit score.

Lenders will take into consideration the amount of the loan the term of the loan and the creditworthiness of the buyer among other factors that are unique to the lender.

Specialty vehicle loans are secured loans with fixed interest rates and funding in as little as one.

Rates terms and fees as of 10 02 2020 10 15 am eastern daylight time and subject to change without notice.